132.3K

Downloads

359

Episodes

Take a profound and distant journey. Call it Deep Travel, Immersive Travel, Slow Travel, or Vagabonding. Francis Tapon guides you to the intersection of travel, technology, and transformation. The podcast will compel you to go beyond your comfort zone. Occasionally, you‘ll also delve into the misunderstood world of cryptocurrencies.

Episodes

Monday May 25, 2020

Zen Pilot Is Flying From Pole to Pole

Monday May 25, 2020

Monday May 25, 2020

Flying to the South Pole and then to the North Pole in a small plane is extremely dangerous.

Robert DeLaurentis, who is known as the Zen Pilot, is on the brink of pulling this off.

I caught up with him when he was grounded in Spain during the Coronapocolypse.

By the time this airs, he should be in Sweden.

He plans to fly over 3 key places around the North Pole in July 2020.

Track his journey on his website.

Questions I asked the Zen Pilot

1. How did you first get into flying?

2. What advice would you get give to someone who wants to become an aviator? Join the military? Take classes? How expensive?

3. Does being a pilot pay little or lot? Or more?

4. You prepared to fly around the world in 95 days. But what surprised you?

5. What's your book, "Flying Thru Life" about?

6. You're flying from pole to pole during the COVID-19. What are some of the unexpected challenges that you faced?

7. When do you expect to finish?

8. How's flying the Drake Passage?

9. When do you expect to finish?

10. What's next?

I mentioned 13 Minutes to the Moon by the BBC.

Watch this 4 mins video about the Zen Pilot

https://www.youtube.com/watch?v=9qox9jVJwew

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

Monday May 11, 2020

BTC Halving: Why is Bitcoin Worth Anything?

Monday May 11, 2020

Monday May 11, 2020

Every four years, there's a US election, the World Cup, and the Olympics. They don't all happen in the same year, but they each have a 4-year cycle.

In a few minutes, there's another event that happens once every for years that few talk about: the bitcoin halving.

To celebrate, I'll give a simplified explanation of what the halving is and why it's significant.

Afterward, I will turn to a more fundamental question: why is bitcoin (BTC) worth more than a dollar and why do I keep talking about it given that I'm mostly known for my travels?

What is the Bitcoin Halving?

Every 10 minutes, a fast bitcoin miner somewhere on the planet gets rewarded for his efficiency. When the bitcoin network was first created in 2009, that reward was 50 bitcoins. Every 4 years, that reward gets cut in half.

On May 12, 2020, bitcoin will undergo its third halving. The reward will drop from 12.5 bitcoins to 6.25 bitcoins.

In 2024, the reward will be 3.125 bitcoins.

This halving will continue to occur every four years until 2140 when it will stop. At that point, we'll have 21 million bitcoins.

The Coindesk chart below sums it up.

Why is the Bitcoin Halving significant?

You're probably familiar with the US Federal Reserve injecting more liquidity into the economy. Some refer to it as "printing money boost the economy."

When the Fed does that, it devalues the dollar. When it does that for a long period of time, it adds up. That's why $1 during George Washington's time would be worth 1 cent today.

Bitcoin does the opposite. Instead of printing more bitcoin every year, we print less bitcoin every four years.

Therefore, the dollar softens over time, whereas bitcoin hardens.

Assuming bitcoin's demand grows slowly, the price will still rise because the supply is growing quite slowly nowadays.

The graph below shows how bitcoin's inflation rate will drop from about 3% in 2020 to below 1% in 2024. And it keeps declining until it has 0% inflation in 2140.

No other asset in history has had 0% inflation. Gold has low inflation, which has helped it retain its purchasing power. Still, we're constantly digging more gold out of the ground. Gold mining inflates the supply by 1-3% per year. As gold's price rises, miners have more incentive to dig for more.

Bitcoin doesn't work that way. By 2140, there will be no more bitcoin to mine. Even by 2036, bitcoin's inflation rate will be 0.1%. In comparison, gold will be at least 10 times more inflationary than bitcoin in 2036.

Shouldn't bitcoin be worthless?

Skeptics who are dumbfounded as to why bitcoin is worth more than a penny. They believe that bitcoin is "fake internet money and one big Ponzi scheme."

Those who declare that bitcoin is a Ponzi scheme don't understand what a Ponzi scheme is and/or don't understand bitcoin. Others incorrectly call it a pyramid scheme.

You can certainly accuse bitcoin of being an economic bubble (like the Tulip mania), but it's not a classic Ponzi scheme.

It's also not a pyramid scheme any more than a company stock is a pyramid scheme.

When an asset bubble pops, the asset's value rarely drops to zero. Even tulips still have value. So why does bitcoin have any value?

There are many long articles and videos explaining why bitcoin has real value. Here's a quick explanation.

Bitcoin has 14 of the 15 key properties of money. Bitcoin is:

- Scarce: only 21 million bitcoins will be mined (and 90% have already been mined).

- Durable: it's as durable as the Internet itself.

- Portable: you can carry millions of bitcoins in your head by just memorizing 24 words.

- Divisible: one bitcoin equals 100 million satoshis. One satoshi is currently worth $0.00007084

- Easy to recognize: yes.

- Easy to store: yes, it can be stored on almost any digital device as well as written on paper or memorized.

- Fungible: yes, bitcoins are mutually interchangeable, just like any currency.

- Hard to counterfeit: unlike other currencies, nobody has ever counterfeited bitcoin

- Widespread use: it's used anywhere where there is the Internet.

- A medium of exchange: thousands of businesses accept it.

- Store of value: although it's highly volatile, it was the best performing asset from 2010-2020 (9 million percent return).

- Able to earn interest or be offered as a loan: companies like BlockFi allow you to earn interest or get bitcoin loans

- Available on debit cards: there are many bitcoin debit cards that allow you to pay in your local currency by instantly withdrawing from one of your bitcoin wallets.

- Available on credit cards: companies like Fold and Blockrize offer bitcoin-friendly credit cards.

- A unit of account: not yet. It's hard to find businesses that price their good or service in bitcoin. Many businesses accept bitcoin, but they list their prices in the national currency or USD/Euros.

Although bitcoin fails in the last criterion, let's remind ourselves of the importance of the first criterion: scarcity.

Gold is relatively scarce, but even if we mined all the gold on the earth, gold's supply wouldn't be exhausted. In this century, you can bet that the gold market will crash once we mine this asteroid:

https://www.youtube.com/watch?v=7PMevBpELT8

Bitcoin, in contrast, has a 21 million cap. Yes, in theory, if the majority of the bitcoin holders and miners agreed to create more bitcoin, they could. However, that would destroy most of the value and be economic suicide. Therefore, it's safe to say that bitcoin is the scarcest commodity or currency.

Still, critics insist, "But bitcoin isn't real like the US dollar!"

Yuval Harari said it best:

Money, in fact, is the most successful story, ever invented and told by humans, because it is the only story everybody believes. Not everybody believes in God, not everybody believes in human rights, not everybody believes in nationalism, but everybody believes in money."

Watch the last couple of minutes of his brilliant TED talk:

https://www.youtube.com/watch?v=nzj7Wg4DAbs&feature=youtu.be&t=684

The US dollar is no more real (or fictional) than bitcoin.

Eric Posner, a law professor at the University of Chicago, stated that "a real Ponzi scheme takes fraud; bitcoin, by contrast, seems more like a collective delusion."

True! Posner should have added, "And all money is a collective delusion."

Ultimately, bitcoin has value for the same reason any currency has value: because a critical mass of humans have decided it has value.

Why bitcoin is here to stay

Several things indicate that bitcoin is not a passing fad.

Bitcoin is a global phenomenon. People from all cultures have managed to understand it and value it. Bitcoin mining rigs cover the planet. Tulips were mainly hot in the Netherlands.

Speaking of tulips, bitcoin has been going at it for 11 years. Tulipmania lasted for 6 months. Other dubious financial schemes fizzle quickly.

Bitcoin has survived at least four major crashes. Each crash brings people saying that "bitcoin is dead!"

The declines are brutal. They usually range from 70-85% declines!

However, when the dust settles, bitcoin creates a new low that was higher than the previous low. This is significant. It proves bitcoin's resistance. It forms a new base and starts climbing again. When it crashes, the price never revisits the previous low.

Bitcoin is too big to fail

Bitcoin's creator, Satoshi Nakamoto, didn't want to help Wikileaks because he knew that the US Federal government could to easily crush the fragile monetary experiment. Nakamoto preferred that bitcoin stay below the mainstream radar until it amassed more nodes worldwide.

In 2020, there are over 10,000 bitcoin nodes in 100 countries. As a result, it's nearly impossible to pull bitcoin's plug. If 20 countries attempt to close all their bitcoin nodes (which is extremely difficult to do), the bitcoin network will keep humming along with the thousands of nodes in other countries.

Think of bitcoin like an operating system (e.g., Windows, iOS, Android). Popular operating systems attract a massive ecosystem around them. Network effects reinforce the utility of the operating system. The more apps get developed for the operating system, the more people want to make sure that the operating system stays healthy and keeps improving.

Bitcoin, which has a market cap of $150 billion, has given rise to a massive industry. Armies of software developers are feverishly developing applications that use bitcoin. Venture capitalists have invested billions in bitcoin-related projects. It's now a beast that's hard for the government to tame.

Bitcoin in 2020 feels like the Internet in 1995. It's beyond the infancy stage, but most people still haven't dipped their toe in it. Still, the network is building out.

Of the roughly 750 currencies that have existed since 1700, only about 20% remain, and of those that remain all have been devalued. - Ray Dalio

On December 31, 2017, I predicted that bitcoin would crash to $4444 in 2018. Bitcoin's price tumbled from nearly $20,000 to $3,200. While I watched the price collapse, a lightbulb went off in my head.

Here's what sealed the deal for me. Throughout 2018, I would be listening to podcasts and reading news about bitcoin. What was fascinating was that bitcoin developers were plowing full steam ahead with complete confidence. The geeky podcasts and websites were discussing the rapid progress in various bitcoin-related projects even as bitcoin's price was tumbling down the abyss.

Developers and CEOs of bitcoin-related companies hardly seemed to care because they knew bitcoin would resurrect itself. In fact, developers secretly prefer working during bear markets because crashes got rid of all the riff-raff and short-term speculators. Only the purists stuck through the hard times. With a smaller network and more technical users, they could work out the bugs before the next bull run.

It was at that point that I realized that bitcoin would bounce back and was remarkably resilient. In December 2018, I predicted that bitcoin would double in value in 2019 and reach $7,300. It ended 2019 at $7,333.

Bitcoin crashes will return. I predict that the crashes will not be as extreme as those in the 2010s. Bitcoin's first crash dropped its value 94%!

I suspect that crashes in the 2020s will rarely exceed 50%.

In the 2030s, they will rarely exceed 40% and so on. As bitcoin gets more widely dispersed, its volatility will resemble the S&P 500.

Another sign that bitcoin is entering the mainstream is that the CNBC, the financial cable news network, regularly reports on bitcoin. Mainstream news media only mention BTC when it's experiencing extreme highs or lows. However, in the 2020s, I predict that you'll see BTC mentioned as often as gold in the mainstream media's financial summaries. When that happens, it will increase the awareness and the demand.

Answers to Common Criticisms

Below are the 10 most common criticisms people have about bitcoin.

1. It's not real money and has no intrinsic value

Short Answer: Fiat currencies have no intrinsic value since they are not backed by gold and can be devalued at any moment. Long answer: see above.

2. Sure, bitcoin is scarce because it only has 21 million bitcoins, but there are thousands of other cryptocurrencies and more being created every day. So cryptocurrencies have no supply limit as they claim.

Bitcoin is software. Microsoft Windows is also software. If someone tells you that Windows has no intrinsic value because there are many operating systems and any team can create more operating systems, would you agree?

There are many colas, but only one Coca-Cola.

Why does the US dollar have any value? Any country can create a new currency. There are 100+ currencies in the world. Is the dollar worthless because the Zimbabwean dollar is worthless?

3. But no country is ever going to price its products in bitcoin, so it has no future.

I agree that it's extremely unlikely that any major country will ever price its goods and services in bitcoin.

However, nobody prices anything in gold grams either. Does that make gold useless?

Only the Swiss price things in Swiss Francs. Does that mean the Swiss Francs are worthless and useless?

Bitcoin can be an international currency without anything being priced in bitcoin. If Tanzanian wants to send shillings to a Congolese, she will have to convert her shillings to dollars, send the dollars, and then the Congolese will have to convert those dollars into Congolese Francs.

Instead of using the dollar, which requires a bank account and high bank transfer fees (e.g., Western Union), the Tanzanian can send bitcoin, which has a much lower transaction fee.

4. "The point is that a real currency’s primary “intrinsic” value is as a medium of exchange or a measuring stick for value. If a centimeter or inch on a measuring tape were constantly changing in physical size, it would not be particularly useful to ask for a six-inch sub. It might end up being the size of an airplane." - The Unassuming Banker

He should call himself the "Unintelligent Banker." Do Australians say that they can't use the US dollar because its value is constantly changing?

It's true that the USD is constantly changing from the point of view of another currency.

Gold's value changes every minute - in relationship with every currency on Earth - including bitcoin.

5. But no matter which currency you compare bitcoin to, it's too volatile.

True, bitcoin's market capitalization is worth less than $200 billion. However, the more it grows in market cap, the more stable it comes.

It's far less volatile today when compared to when it was worth less than $200 million.

When it reaches the value of gold ($10 trillion), then it will have the same volatility as gold.

Furthermore, bitcoin is far less volatile than some hyperinflating currencies (e.g., the Venezuelan bolivar, the Zimbabwean dollar, & the Argentine peso). If you believe that the US dollar will devalue in this century, then bitcoin will, one day, be less volatile than the US dollar too.

6. It facilitates criminal activity because it's anonymous.

First, every bitcoin transaction is recorded on a worldwide public ledger. If you buy a meal with bitcoin, that transaction will be recorded on thousands of computers throughout the world.

Many companies and governments are analyzing bitcoin's ledger and catching all sorts of criminal activity.

That's why most smart criminals have turned to more private cryptocurrencies such as Monero and Z-Cash.

This 30-minute documentary is an outstanding summary of bitcoin's implications

https://www.youtube.com/watch?v=LszOt51OjXU

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

Sunday May 10, 2020

80,000 COVID vs. 80,000 Flu Deaths

Sunday May 10, 2020

Sunday May 10, 2020

As of today (May 11, 2020), 80,000 Americans have died from COVID-19.

In 2018, 80,000 Americans died of the flu. It was a bad flu year.

You can watch this on YouTube too.

It's fascinating how we look at death.

The Infection Fatality Rate of COVID-19 is about 10 times worse than influenza.

Therefore, if we didn't shelter in place, perhaps we would have lost 10x more Americans than the 2018 flu season, which would mean about 1 million deaths.

I've been called callous. But imagine if:

- We treated airline flights like rocket launches - and took 7 hours to go through all the safety checks.

- We set a 10 MPH speed limit nationwide.

- We mandated a nonstop shelter in place to stop the 5 million deaths from communicable diseases.

Such draconian measures would save thousands of lives. But would you be in favor of them?

Not all lives are equal

If a US soldier is KIA, his family gets $100,000

When the US military accidentally killed an Afghan boy, they gave his father $1,000 as compensation.

It easy to make deaths look meaningful and meaningless

Cite 9/11 and you'll get people emotional quite quickly.

Cite a big number to put things in perspective. For example, 5 million people die from communicable diseases every year:

- Lower respiratory infections: 3 million

- Diarrhoeal infections 1.5 million

- Tuberculosis: 1 million

That's 4.5 Sept 11th happening every day of every year.

It's not either open the economy or close the economy

There's the Swedish way, which allows some opening:

- Schools are open since kids are at low risk.

- People are encouraged to shelter in place.

- The old are asked to stay home.

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

Monday May 04, 2020

8 Flaws in Bitcoin’s Stock-to-Flow Model Will Doom It

Monday May 04, 2020

Monday May 04, 2020

Read the article or watch the video about this podcast. It's helpful to see the graphs.

I copied the article and graphs below, but use this link if the images don't pop up in your podcast player.

https://www.youtube.com/watch?v=3k4CTL6fowA

8 Flaws in Bitcoin's Stock-to-Flow Model Will Doom It

I love Bitcoin. Nothing would make me happier than to see one of Plan B's optimistic stock-to-flow (S2F/STF) models become an accurate predictor of Bitcoin's price.

Up until now, there has been a non-spurious relationship between stock-to-flow and bitcoin's price. That's one reason it's such a compelling narrative.

I hope I'm wrong, but, inevitably, BTC's stock-to-flow models will diverge dramatically from their predicted trendline. This article doesn't distinguish between the original S2F model and the latest S2FX model since they share a similar concept.

FYI: I am writing this while the world is counting down the hours to bitcoin's third halving, which will occur on May 12, 2020. BTC costs nearly $9,000.

What is the hypothesis of bitcoin's stock-to-flow model?

Bitcoin, like gold, has a relatively large existing stock compared to the annual flow of new bitcoin mined.

Gold, unlike most metals, sees its total stock increase relatively slowly compared to its existing stockpile. There are about 200,000 tons of gold (the stock) and we mine about 3,000 tons of new gold annually. In other words, gold's flow adds about 1-2.5% to its annual stock.

That results in a stock-to-flow ratio of roughly 65. That means that if halted gold mining today, it would take us to 65 years to consume the existing stock. I've seen lower and higher S2F estimates, so let's assume that 65 is close enough.

Gold's stock to flow is much higher than any other metal, which partly explains why it's so valuable.

Bitcoin is similar to gold in that it also has a high stock-to-flow ratio. The amount of newly mined bitcoins is tiny when compared to the existing stock of bitcoins.

Therefore, the hypothesis is: as bitcoin's stock-to-flow rises, so will its price.

So far, that's exactly what has happened up until the 2020 Halving. Will the pattern continue?

The stock-to-flow tale is such a compelling and powerful narrative that it's become a viral hit among bitcoin fans.

I certainly bought into it enthusiastically.

Stock-to-flow models bitcoin's price predictions

The original stock-to-flow model predicted that BTC will reach $55,000 in 2020. That means BTC needs to jump 7 times in value in the next 7 months.

On April 27, 2020, Plan B presented his BTC S2F Cross Asset (S2FX) Model. The S2FX predicts that by 2024, BTC with be worth an eye-popping $288,000.

This sounds too good to be true.

This article explains why both stock-to-flow models will soon fail.

Since most people who are reading this don't know me, here are a few facts about me in case you're wondering, "Who the hell is this asshole?":

- I'm not a newbie. I first bought BTC when it was $250. (My brother bought 10 BTC when it was $1 each - and then got hacked and lost it all).

- I accurately predicted BTC's 80% price drop in 2018.

- I nailed my 2019 prediction within $33.

- I'm a Harvard MBA, so I like to analyze numbers.

8 problems with Plan B's stock-to-flow bitcoin models

For those who don't like to read, you can watch the video:

The list goes from the least important problem to the most important problem.

Problem #8: Not everyone agrees on what is gold's stock-to-flow ratio

Although most quants agree that gold's stock-to-flow ratio is in the 60s, a few believe it's much higher. For example, Philip Barton, a gold analyst, argues that gold's stock to flow is between 400 and 800!

Admittedly, Barton is an outlier. The consensus is that gold's stock-to-flow ranges between 50 and 70. Still, it's worth noting that some believe there is far more stock out there than we realize. How could gold's stock-to-flow ratio be 800?

The main reasoning is that when humans first started collecting gold, there was a lot of low-hanging fruit. Enormous gold nuggets were easy to grab in the streams and other sources. It's reasonable to assume that for billions of years, gold nuggets just sat in the streams since no animal valued them.

When humans began collecting gold, the global gold stock must have soared exponentially. Its curve must have looked like the first decade of bitcoin's supply curve.

That's why Barton and others believe that gold's stock-to-flow ratio is 10 times higher than what most people think it is.

If that's true, then bitcoin's stock-to-flow model is somewhat inaccurate since it predicts that bitcoin will exceed gold's stock-to-flow ratio by 2025.

This problem is the least of all the problems with bitcoin's stock-to-flow narrative. It gets worse.

Problem #7: Gold's stock-to-flow isn't fixed

Plan B presents timelines that show bitcoin's ever-rising stock-to-flow ratio. In those charts, he depicts gold (and silver) as a single data point, as if their stock-to-flow ratios are constant.

For example, in Plan B's chart below, you'll see how bitcoin's stock-to-flow ratio has risen over 10 years. Meanwhile, on that chart, Plan B depicts gold stock-to-flow (SF) fixed at 62 and silver's SF 22.

Bitcoin's stock-to-flow model gives you the impression that gold's stock-to-flow is nearly constant.

The reality is that gold's stock-to-flow ratio is constantly fluctuating.

Here's a chart that shows that gold's average stock-to-flow is 66, but it's had a wide range over the last 120 years.

Gold's stock-to-flow ratio has gone as low as 45 in 1940 and as high as 90 in 1920. Gold has bounced around those extremes.

Problem #6: Gold's stock-to-flow does not drive its price

Plan B observed that because bitcoin's mining flow gets cut in half every four years, bitcoin's stock-to-flow ratio leaps every 4 years. These halving events boost Bitcoin's stock-to-flow ratio dramatically. It's reasonable to assume that the contracting supply is fueling the BTC's dramatic price rise.

Intuitively, the stock-to-flow model makes sense once you conduct a simple thought experiment. Imagine if the flow of gold suddenly slowed to a trickle. Instead of 3,000 tons of gold being mined annually, we only managed to dig 3 tons of gold each year.

What do you predict would happen to gold's price?

It would skyrocket, right?

That's because investors, national banks, jewelry makers, phone makers (0.034 grams of gold in each phone), and other industries that use gold would have to fight over a (nearly) fixed supply.

Still, if the stock to flow ratio were such a great price predictor, then we should see gold analysts use it all the time.

But they don't. Gold bugs only cite gold's stock-to-flow to help explain why gold has monetary value. But they don't use it to predict gold's price.

That's because, as you can see from Voima's chart below, gold's stock-to-flow ratio is sometimes uncorrelated to gold's price.

The above chart is a bit misleading because it only shows the nominal price of gold, which, prior to 1971, was fixed by the government.

Below, is the real, inflation-adjusted price of gold. When you examine the red line, overlay the cyclical stock-to-flow line over it. You'll see no correlation.

For example, in the graph above, you can see that the STF hit a high of 95 around 1920. But below, you can see the inflation-adjusted price is rather low in the 1920s. You'll see the opposite when you compare the 1940 numbers.

In short, gold's price is uncorrelated to its stock-to-flow ratio.

I haven't read a single gold expert argue that stock to flow drives the price of gold over the years.

However, according to the S2F model, the alleged driver of bitcoin's price rise is its ever-increasing stock-to-flow ratio. As bitcoin's stock-to-flow ratio goes up, bitcoin's price follows. That is the thesis.

That implies that if bitcoin's stock-to-flow ever stabilizes, then its price should stabilize too.

Gold's stock-to-flow and price history tells a different story. Over the last 120 years, gold's STF ratio has gone up and down in a relatively narrow range. However, gold's inflation-adjusted price has gone all over the place.

Problem #5: Some metals with extremely low stock-to-flow ratios are worth more than gold

In the chart below, Plan B noted the stock-to-flow of other metals besides gold and silver:

By one estimate, platinum has a measly stock-to-flow ratio of 1.1.

This surprised me because, in Dungeons & Dragons, one platinum piece is worth 10 gold pieces (back when I played, the roleplaying game used a 5:1 ratio).

In reality, it's not that big of a difference. Still, ounce-to-ounce, platinum usually costs more than gold.

It's the same story with palladium.

Palladium has a paltry stock-to-flow ratio of 0.4.

But you wouldn't guess that after looking at its price versus gold and platinum.

Therefore, there's clearly a disconnect between stock-to-flow and price in the world of precious metals.

That's why metal quants and forecasters hardly mention stock-to-flow when making price predictions.

Some may say that palladium and platinum are commodities whereas gold's high stock-to-flow ratio puts it in a different category: a monetary metal.

True, but it raises some concerns about how tightly we should link stock-to-flow to the price.

Stock to flow is important, but it's not the main driver behind the price of metals.

It's just one of many important factors.

Problem #4: STF doesn't explain the prices of other cryptocurrencies

Not only does stock-to-flow explain why palladium and platinum are often worth more than gold despite having tiny stock-to-flow ratios, but it also fails to explain the value of other cryptocurrencies.

In the vast universe of shitcoins, there are some that have a stock-to-flow ratio that is much higher than bitcoin and gold. If not, we could invent one tomorrow. But that wouldn't make it valuable.

Jan Nieuwenhuijs makes exactly that point in my interview with him (see it below). He says that we could create a cryptocurrency that halves every day instead of every four years. We could engineer one that has a stock-to-flow of 50,000. However, unless there's demand, that cryptocurrency would be worthless.

Problem #3: STF assumes that bitcoin's demand continues to grow exponentially

The Achilles heel of bitcoin's stock-to-flow model is that it only looks at supply.

Economics 101 teaches you that the price of anything is driven by supply and demand. If you only know the supply, you cannot predict the price.

Jan Nieuwenhuijs is a gold guru who is also a Dutchman like Plan B. Jan said it succinctly, "If there is no demand for something, the value is zero."

In other words, Bitcoin's tightening supply is only half the story.

Since its genesis, bitcoin has enjoyed a robust, growing demand. Indeed, bitcoin's demand has usually outstripped the supply, which explains why bitcoin's value has been rising despite its double-digit inflation rate throughout the 2010s.

The stock-to-flow model will be accurate provided that the demand continues to grow exponentially as it has for the last 10 years. However, as Facebook is discovering, there are fewer than 8 billion potential customers on this planet. Bitcoin will ultimately reach market saturation.

But long before that, it will run into a much more serious barrier...

Problem #2: STF underestimates the powers that be

The stock-to-flow model underestimates the challenge of maintaining the same exponential growth as your size increases.

When bitcoin went from a $1 million market cap to a $100 million market cap, the world hardly noticed or cared.

Going from a $100 billion market cap to a $10 trillion market cap is also 100x growth, but it is orders of magnitude more difficult to do.

That's because if bitcoin has a $10 trillion market cap, it's no longer a fly in the room. It's an elephant in the room. That would make bitcoin's market equal to the 3,000-year-old gold market!

In the What Bitcoin Did podcast, Plan B told the host Peter McCormack that bitcoin "is not a toy anymore."

True. When it was a "toy" in the 2010s, the power players kept a wary eye on it, but they hoped it would stay small or disappear.

If bitcoin manages to grow into the next phase transition, it will step on many toes that have sharp claws. Bitcoin will disrupt industries, but not without a fight. Bitcoin will survive but will suffer blackeyes and slower growth as a result.

In the next phase transition, bitcoin will begin to bump its elbows against many entrenched powers: regulators, governments, banks, tax authorities, Western Union, financial services, environmentalists, gold bugs, the FBI, the CIA, and grumpy old baby boomers.

If bitcoin threatens them, they will do whatever it takes to stop bitcoin and preserve the status quo.

Bitcoin fans underestimate how powerful these entities are. Although these powerful organizations cannot destroy bitcoin, they will slow down bitcoin's adoption (i.e., the demand). They will erect troublesome roadblocks. They will impede (and perhaps stop) bitcoin's ability to continue rising to the next "phase transition."

It's naive to underestimate these future challenges, but the stock-to-flow model ignores them.

To be realistic, the stock-to-flow model ought to have some "deceleration factor" in the calculation. That's because each "phase transition" becomes progressively more difficult to achieve.

Problem #1: S2F defies physics

Some critics say that the stock-to-flow model will break in 2140, which is when we cannot mine new bitcoins. At that point, the S2F model predicts that the price of bitcoin will go to infinity.

Although that is a problem, bitcoin's stock-to-flow model is doomed to break at least 100 years before that date.

Bitcoin's stock-to-flow model predicts exponential growth into the foreseeable future. Such sprightly growth is necessary for bitcoin to hit the $55,000 target in 2020 and its $288,000 target in 2024.

Bitcoin has already been the best performing investment in the 2010s.

For the stock-to-flow model to continue working, bitcoin will need to be the best performing asset in every single decade in this century.

Pick any asset that has skyrocketed exponentially. It could be the stocks from technology companies, gold in the 1970s, or tulips a long time ago. Every single time, without fail, the asset's growth slows and never consistently regains its fierce rise.

It might occasionally have other growth spurts, but a sustained, nonstop rise never happens. However, the stock-to-flow model predicts dramatic exponential growth for several decades.

According to digitalikNet's S2F projection, in 2050, one bitcoin will be worth more than $1 trillion!

Two things would have to happen for such a Panglossian scenario to occur:

- Bitcoin's price would have to double every year, on average, for the next 30 years. That's 30 doublings! No asset has ever come close to such a performance. Maybe pre-IPO Microsoft or Google or Walmart had such a rise for 10 years. But doublings become extremely difficult once an asset becomes large.

- We would need to invent nuclear fusion reactors and become a Type 1 Civilization. Bitcoin consumes vast amounts of energy. The higher the price goes, the more it consumes.

Unless Bitcoin solves its energy consumption problem, its growth will suffer. It doesn't matter if that environmental critique is correct or not. If the powers that be want to destroy bitcoin, they can use bitcoin's hungry energy consumption as an excuse to ban it or tax it prohibitively.

"Stop bitcoin to stop global warming!" lobbyists will cry.

Overcoming that challenge will slow bitcoin's growth.

The current world economy is nearly $100 trillion. If one bitcoin were worth $1 trillion, then just 10 bitcoins would be equal to the 2020 global economy.

In 2050, there will be about 20 million bitcoins. Therefore, in 2050, if the stock-to-flow prediction is correct, then the bitcoin's market cap would be $1 trillion x 20 million coins = 20 x 1018

If we make the rosy assumption that the world economy grows 10-fold between 2020 and 2050, then we will have a $1,000 trillion economy or a $1015 world economy.

Therefore, the bitcoin market cap would be 1,000 times more than the total global economy - which is impossible.

In short, the stock-to-flow model is doomed.

The S2F price prediction may be right in a perfect storm

I want S2F to be right. I would be thrilled to be wrong. Let's try to imagine a scenario where it proves to be prescient.

Bitcoin may follow the next two stock-to-flow predictions if demand stays at a feverish pitch. For that to happen, we'll need the global economy to collapse, the dollar to devalue, governments to confiscate people's wealth, and widespread pandemonium.

Less than 1% of humans own bitcoin. And most who do, don't own much relative to their wealth.

If new buyers flood the market just as Bitcoin truly begins hardening its monetary policy, then that will create a perfect storm for bitcoin to continue its improbable rise.

Hyperinflation will increase the nominal value of the dollar and we'll get into the trillions quite quickly.

That reminds of a few years ago when I held a fat stack of 100-billion-dollar bills.

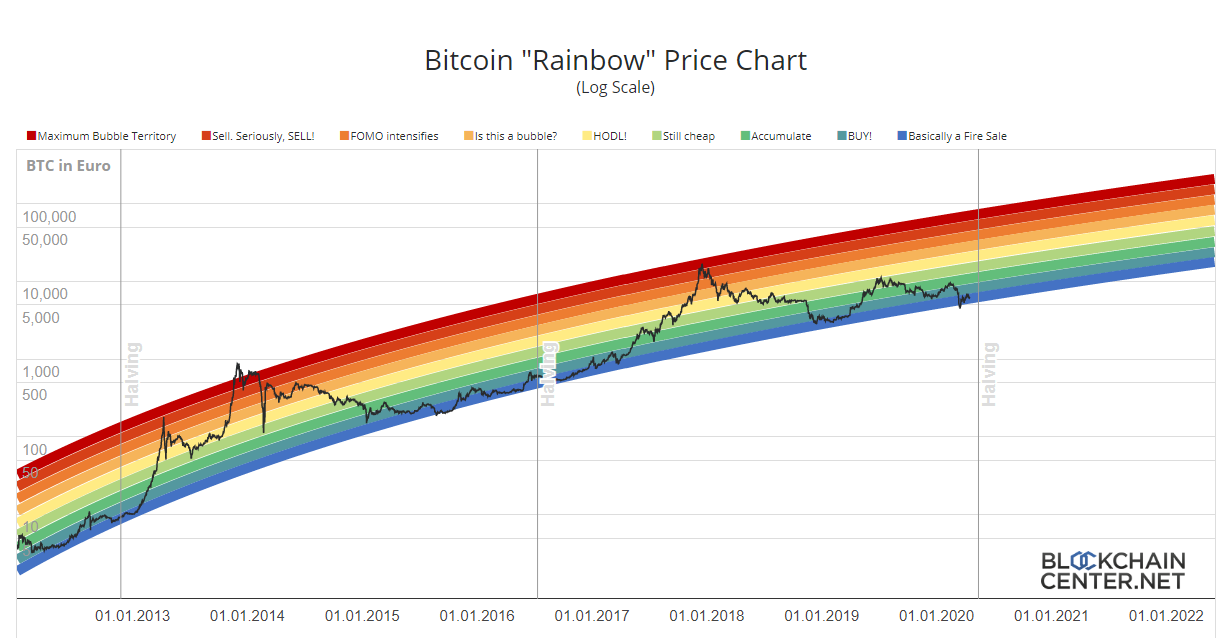

Lessons from the Rainbow Chart

Check out the whimsical, but surprisingly accurate, Bitcoin Rainbow Chart below.

I love what its creator said about the Rainbow Chart:

"The color bands follow a logarithmic regression, but are otherwise completely arbitrary and without any scientific basis. In other words: It will only be correct until one day it isn’t anymore."

The same can be said with the stock-to-flow model.

Setting expectations about bitcoin's stock-to-flow model

Plan B would probably say that I'm missing the point.

In the What Bitcoin Did podcast, Plan B told the host Peter McCormack that he "accepts that models will break." Plan B also recited two proverbs:

All models are wrong, but some are useful.

I'd rather be roughly right than exactly wrong.

Well said.

Furthermore, Plan B set modest expectations. He said, "I'd be happy if it would only forecast the next halving or the next two halvings correctly. That would be very useful."

True.

IMO #bitcoin 2020 halving will be like 2012 & 2016. As per S2F model I expect 10x price (order of magnitude, not precise) 1-2 yrs after the halving. Halving will be make-or-break for S2F model. I hope this halving will teach us more about underlying fundamentals & network effects pic.twitter.com/kiTdN0n3Lu

— PlanB (@100trillionUSD) April 16, 2020

Plan B predicted that the "halving will be make-or-break" his stock-to-flow model.

I hope it will make it, but unfortunately, I believe it will break it.

I predict that there's a 70% chance that bitcoin's stock-to-flow model will break in 2020 and a 95% chance that it will break by 2024.

Each 4-year step (at the halving) gets progressively more difficult for the price to keep up. In 2025, if bitcoin isn't worth $1 million, S2F is dead. The last big jump of this decade predicts that one bitcoin will be worth $50 million by 2029. Only hyperinflation will get us there.

So where will Bitcoin's price go?

I commend Plan B for offering a model to help understand bitcoin's past and future. Whenever you criticize something, you ought to offer a solution. So I will.

My prediction is even less scientific than the Rainbow Chart.

Beware of all price predictions, including mine although I've been accurate in my annual predictions (but I've only had two).

I am certain that Bitcoin will continue to rise and baffle its many critics. It will march toward a $10 trillion market cap. It just won't do it as fast as the stock-to-flow model predicts.

On December 31, 2019, I predicted that bitcoin would end above $10,000 in 2020 and that there's a 30% chance that it will close above $20,000. I also predicted that it will reach $100,000 in this decade.

Such predictions make my friends chuckle and shake their heads. They say I'm naively optimistic about this "imaginary money and Ponzi scheme."

Meanwhile, stock-to-flow fans laugh at my predictions for being too conservative. They believe BTC will hit $100,000 by May 2021 and $50 million by 2029.

In between those two predictions is Tim Draper, who predicted that bitcoin will hit $250,000 in 2023.

The main reason I'm more conservative than many bitcoin fans is that I expect entrenched powers to take off their gloves and pummel bitcoin. Bitcoin will survive, but its growth will take a hit.

Besides, a 14x return in a decade would be quite spectacular. Most assets would be happy with a 2-3x return in 10 years.

Conclusion

The stock-to-flow model has been a novel way of looking at bitcoin's early, meteoric years.

However, it will soon break because it predicts nonstop doubling year after year. Our solar system prohibits nonstop doubling.

Let's be happy with a 14x return in the 2020s. That would result in a $100,000 BTC price in 2029.

Still, I secretly hope I'm wrong and that the stock-to-flow model is right.

Additional information

Read all 3 of Plan B's articles. Become one of Plan B's 100,000+ followers on Twitter.

Jan Nieuwenhuijs, a gold researcher and early bitcoin adopter, discussed bitcoin's stock-to-flow in my interview with him:

https://www.youtube.com/watch?v=XErx5c-DxHk

Thanks to the Gold Broker for several of these graphs. Also, I copied Rob Wolfram's daily S2F graph.

Here is a more quantitative critique of the stock-to-flow model.

If you like this podcast/video, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

What do you think of the stock-to-flow model? Leave a comment below.

Friday Apr 24, 2020

Gold Expert On Bitcoin, Stock-To-Flow, Asteroids, Depression

Friday Apr 24, 2020

Friday Apr 24, 2020

When I travel, I love to observe common ground in a sea of diversity.

The planet has over 100 currencies, but there's one thing that everyone agrees is money: gold.

So far, COVID-19 has killed 200,000, which has added to the 5 million deaths that we suffer from communicable diseases every year.

COVID-19 has also killed the global economy.

The travel industry has shut down.

The stock market is in tatters.

The prices of panic assets (gold and bitcoin) have soared.

Few are talking about a recession.

We're on the edge of a depression.

Therefore, we're taking a breaking from talking about travel and focusing on universal money: gold.

I talk with a renowned gold researcher, Jan Nieuwenhuijs.

We discuss:

- Whether gold's stock-to-flow ratio helps determine gold's price.

- What he thinks of bitcoin using the stock-to-flow to predict bitcoin's price.

- Why he bought bitcoin for $25 and why he sold it in 2017.

- What he thinks of asteroid mining.

- How do buy and store gold safely and effectively.

Learn more about Jan at Voima Gold and Twitter @jangold_

Jan wrote several fascinating articles:

- Gold: Supply and Demand Dynamics.

- Why you should not buy the GLD Gold ETF to get exposure to gold.

- What's an SDR and its future?

- The coming gold standard.

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

Sunday Apr 12, 2020

Bitcoin vs. Other Crypto Currencies

Sunday Apr 12, 2020

Sunday Apr 12, 2020

Last week, I got this email from Robert Hahn, whom I interviewed a couple of months ago on this podcast. He wrote:

Hey Francis! I listened to your most recent podcast with Rejoice. Afterwards I looked into investment in crypto a bit. I was wondering what your thoughts are on platforms for buying and storing the virtual currency. I was also interested in Nano (for its more environmentally conscious approach) and Monero (better privacy, but that may be a fault because it makes it a favorite for dark money). I'd be curious to hear why you chose Bitcoin...the assumption that widespread adoption will win the race?

For the best platform for buying cryptocurrency, I like Kraken.

https://r.kraken.com/Q1RBx

For storage beyond what you're comfortable losing, Ledger is a great bet.

https://shop.ledger.com/pages/ledger-nano-x?r=a673bccc2782

I answer some of his questions in a general way and I didn't talk too much about the two crypto coins that I mentioned, so I will address them here in the notes briefly.

First, I love to use CoinMarketCap.com to see the market share of the crypto coins.

Nano is ranked #60 (as of April 12, 2020). That's a deal-breaker for me.

I would research a top 20 coin and I would take a good look at a top 10 coin, but if it's not in the top 20, then forget about it. It's insignificant and will probably remain so. It won't change the world. And it will probably fade away.

I'm sure some critics would question its environmentally responsible claims.

Bitcoin is a power hog, but that's the price we pay for having bulletproof security. So far, more environmentally friendly solutions have their problems.

Remember, the global banking system requires far more resources than Bitcoin.

Monero is a fascinating privacy coin that is ranked #14.

As cool as it is, ZCash has slightly better technology and you can create privacy features within Bitcoin via technologies such as:

- The Lightning Network

- Mimblewimble

- CoinJoin

- Wasabi Wallet

There are MANY efforts researchers are making to improve Bitcoin's privacy.

I suspect current solutions will satisfy most privacy enthusiasts.

If they don't, then Bitcoin developers will probably come up with a better solution soon. There are armies of brilliant programmers researching this issue. Other coins lack such development teams.

You can watch this podcast at:

https://www.youtube.com/watch?v=6SIGGxKGagU

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

Saturday Apr 11, 2020

Solving the Coronavirus Crisis

Saturday Apr 11, 2020

Saturday Apr 11, 2020

How do you think we should solve the Coronapocolypse?

Should we keep sheltering in place for another month or two?

What metrics would you look at to decide when enough is enough?

Rejoice and I debate my solution to the Corona crisis.

Rejoice also shares a few stories from Africa during this bizarre time.

Leave your comments and solutions at WanderLearn.com.

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

Saturday Apr 04, 2020

Don't Hike Your Own Hike in 2020

Saturday Apr 04, 2020

Saturday Apr 04, 2020

Is the Coronavirus is overly hyped?

Rejoice and I discuss that.

I explain why you shouldn't hike your own hike in 2020.

But that doesn't mean you shouldn't hike in 2020. I explain how and where to go hiking in 2020.

Rejoice shares how COVID-19 is impacting Africa.

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

Thursday Mar 26, 2020

Thru-Hike To Escape the Coronapocolypse

Thursday Mar 26, 2020

Thursday Mar 26, 2020

Thru-hiking can take social distancing to an extreme.

Unless you camp close to random people or you spend lots of time in town when you resupply, you will be safely away from any contagion.

That's why 2020 is the best year ever to thru-hike, especially if you recently lost your job.

Put your stuff in storage (or sell it all). Stop paying rent. And hike for the next 6 months.

By the time you finish hiking, the Coronapocolypse will have killed a few million people and ravaged the economy while you were happily backpacking.

You'll return to civilization in the post-apocalypse - and just in time to vote for in the US elections.

I recorded the following podcast with Gehn Shibayama a month before the Coronavirus outbreak. What we discuss is extremely relevant for the 2020 pandemic. We discuss:

- How thru-hiking the Pacific Crest Trail is different now that it was 15 years ago.

- How two East Asians females died on Pacific Crest Trail a couple of years ago.

- How thru-hiking El Camino de Santiago has changed in the last decade.

- How to invest your money (super relevant today now that the markets have tanked - thereby making it a great time to invest).

- Why he was a trail angel in 2019.

- Why do some vegans not tolerate people using their kitchen utensils to cook animals?

- How can one retire before 50?

- What's he planning to do in the 2020s?

A few fact-checking corrections:

We debated the pros and cons of thru-hiking the PCT southbound. On the podcast, I estimated that you need 3 months to thru-hike the Canadian border to Kennedy Meadows. I couldn't remember the exact time that I had calculated years ago. It's all in my "Why Go Southbound on the PCT" article. I explain that takes 3.5 months to cover those two points, which is the same amount of time that northbounders have to cover that distance. Therefore, I'm sticking with my recommendation of going south on the PCT. You just need to get in shape before you leave.

Gehn said that Scott Williamson has thru-hiked the PCT 7 times. I said that he's done it "more than 10 times." Fact check: he's thru-hiked the PCT 13 times.

What's clear is that this is a fantastic year to thru-hike the PCT. Snow levels are normal. Go for it.

I hope Gehn inspires you to thru-hike the Pacific Crest Trail.

Connect with Gehn Shibayama's Facebook profile.

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV

Saturday Mar 21, 2020

Don't Worry Too Much About COVID-19 and the Coronapocolypse

Saturday Mar 21, 2020

Saturday Mar 21, 2020

On March 20, 2020, Rejoice and I spontaneously went Live on Facebook to share our thoughts about the Coronavirus pandemic.

(Don't worry. The photo of us hugging was taken months before the Coronapocolypse.)

In 2014, when the Ebola contagion was raging across West Africa, I was traveling in West Africa. The world was panicking. Some worried that it would kill hundreds of thousands, perhaps millions.

I thought most people were overreacting. Therefore, I wrote a prescient article called, "Don't Worry Too Much About Ebola."

I feel I could write the same article today about COVID-19.

Yes, Ebola and COVID-19 are different viruses.

COVID-19 spread far and fast; Ebola didn't.

Ebola's death rate was 53%. COVID's death rate is about 3.5%.

Still, the principle is the same.

Humans excel at detecting patterns.

However, we have a tendency of over projecting trend lines.

When we see a graph skyrocketing (or plummeting), we often believe (incorrectly) that the trend will continue for a long time.

It often doesn't.

Listen to my podcast with Rejoice. Sorry that her voice is sometimes hard to hear. She speaks softly.

Lastly, don't misunderstand me.

I'm not suggesting that we should ignore COVID-19 or that it's not serious. We should continue taking the extreme measures we're taking such as sheltering-in-place.

I'm simply saying that we shouldn't panic or believe that this contagion will kill tens of millions.

A few months ago, I gave my third TEDx talk, which was about the 7 surprising lessons I learned from picking up 3,000 African hitchhikers.

At the 14th minute, I shared a statistic that is relevant today during the #Coronapocolypse. I queued up the video link below to that moment in the talk.

https://youtu.be/5WxfRLByD60?t=833

Spoiler alert: Every year, 470,000 humans die worldwide from influenza.

Today, 14,000 have died worldwide from COVID-19.

That sucks, but even if 100 times more people die from COVID-19 than the flu (which would 1.4 million, that would mean that COVID-19 is only 3 times more deadly than our annual flu.

That would suck, but let's keep those statistics in mind before we all jump off a moderately tall building.

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at FT@FrancisTapon.com

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV